Introduction

Gross Domestic Product (GDP) measures the market value for all products and services within a country's borders. GDP Growth Rate is the percentage increase in GDP from quarter to quarter. To avoid double counting, GDP includes only the final product value; intermediate goods like shoelaces in a shoe are not counted.

Identity: GDP = Consumption + Investment + Government Spending + (Exports – Imports)

Objectives

- Compare GDP growth between developed (USA, China, Kuwait, etc.) and developing nations (Nepal, Pakistan, Bangladesh, etc.).

- Quantify how financial/economic indicators correlate with GDP.

Algorithm Used — Linear Regression

- Supervised ML algorithm modeling a linear relationship between a dependent variable (GDP) and multiple indicators (imports, revenue, taxes, net exports, etc.).

- Chosen for interpretability and to estimate strength of each indicator’s association with GDP.

Methodology

- Data collection

- Cleaning

- Preprocessing

- Visualization

- Model training & testing (Linear Regression)

Data Source & Cleaning

World Bank datasets (1997–2021) across South Asia, North America, and MENA; ~32 countries. Indicators split by type (currency / percentage / number). NA values replaced with 0 per documented reasons in metadata rather than mean imputation across countries.

Visualization & Findings

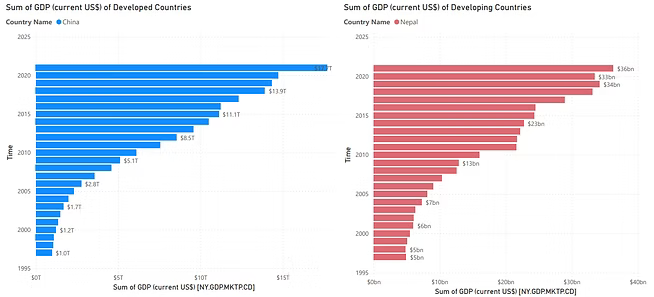

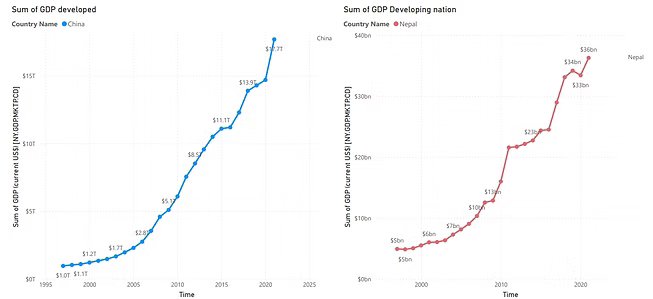

Nepal vs China — Total GDP Over Time

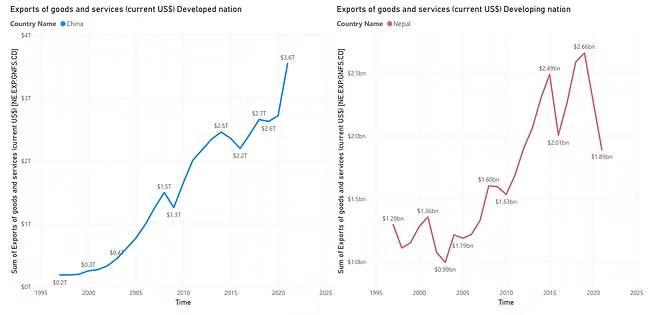

Exports of Goods & Services

GDP Per Capita Over Time

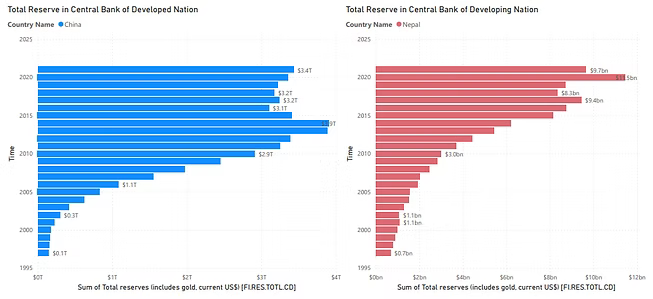

Total Reserves (incl. gold)

Gross National Income (GNI)

Predictive Modeling

Data split 70/30 (train/test). Linear regression on the currency indicators achieved an R² ≈ 0.99 for this dataset, suggesting a very strong linear fit.

Conclusion

GDP is strongly affected by trade and financial indicators and by country-specific shocks. Nepal shows sensitivity around the 2015 earthquake and the 2020 pandemic; export strength and reserve policies materially influence outcomes.

References

- World Bank indicators (Population, Reserves, etc.)

- Migration Data Portal (international migrant stocks)

- 2005 Nepal coup d’état — background context